Our specialist Huawei phone insurance policies cover a wide range of models, from the P10 Lite right the way through to the latest P30 Pro and Mate 20 handsets. Depending on your individual needs and requirements, you can choose either our Plus or Premium plan.

loveit coverit include cover for Theft and Loss as standard in all of our iPhone policies!

Statistically, people are most likely to claim for Cracked Screen Cover - that's why we include it in our Premium cover. We will speedily and efficiently repair or replace your smashed screen.

Our Accidental Damage and Liquid Damage Cover, which we include in our Premium Huawei policies, provide even the most accident-prone customers with peace of mind.

All of our Huawei policies include Worldwide Cover. We will also protect your Accessories, so that they are safe while you travel. What's more, we will cover any unauthorised calls that have been made.

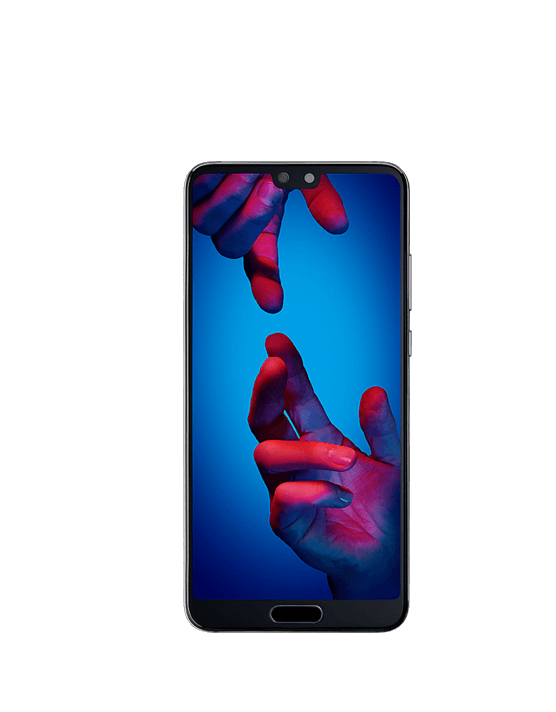

Whether it’s the great-value Huawei Mate 10 Pro, the highly impressive P20 Pro or the brand new Huawei P30 Pro, we cover them all. With 3 decades in the mobile phone insurance industry, we’ve seen every Huawei handset ever released. That’s how we know what Huawei users want from their phone insurance.